Development

Power Dynamics: The Founder-Investor Relationship in the Startup Industry

At the heart of the startup ecosystem lies the relationship between founders and investors, an intricate partnership founded on mutual trust, shared goals, and the understanding that both parties are integral to the startup's success. This relationship evolves through various stages, each marked by its own set of challenges and power shifts.

This blog draws on insights from various resources to shed light on the complexities of this relationship, offering guidance for both parties to navigate their partnership effectively.

The Initial Engagement: Setting the Stage

The journey begins with initial engagements where founders and investors test the waters. Founders present their vision, hoping to ignite interest, while investors evaluate the growth potential and assess risks. This stage is crucial for building a foundation of trust and alignment, with investors looking for teams that not only have a compelling vision but are also capable of executing it.

According to Christian Knott's model, at this point, stakes are not that high for any party; for investors, it is “just another pitching session,” and founders are probably looking for funding in other places and are not putting all eggs in one basket. Knott mentions how the BATNA (best alternative to no agreement) for the investor at this stage is simply walking away. Parties are unrelated, so he represents them with simply two dots “floating” in space and looking for their best fit, with no strings attached yet.

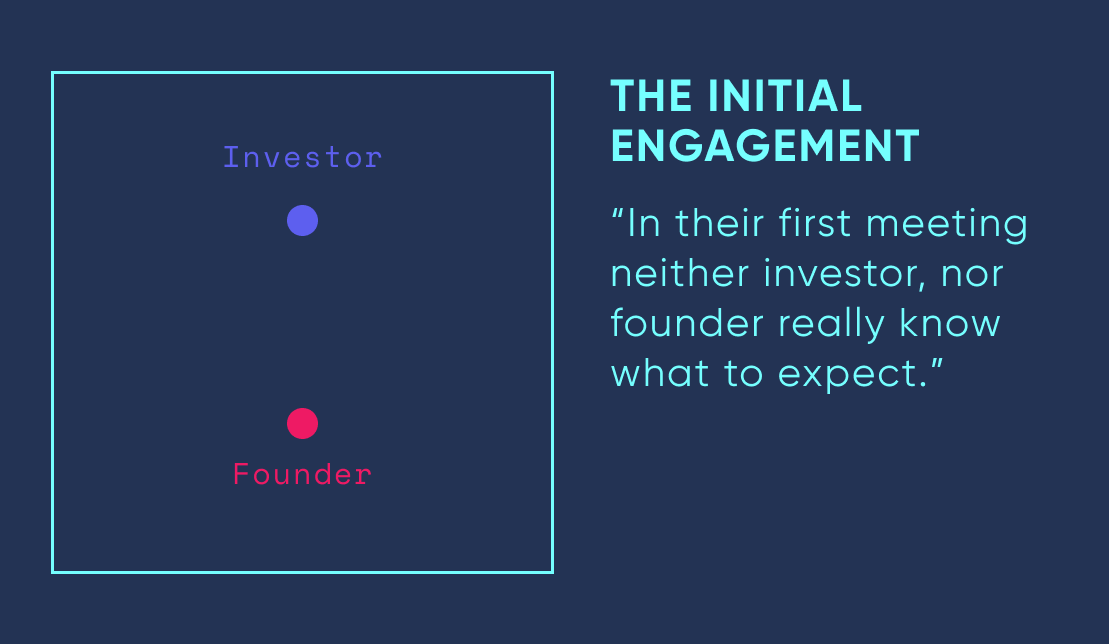

Dynamics at Play: Power Shifts and Engagement Begins

As the relationship progresses, the dynamics of power begin to shift. Initially, investors hold significant leverage due to their financial resources and the amount of pitching sessions they attend. However, this balance can quickly shift as investors spend more time and resources on due diligence, increasingly investing in the startup's success. While building a closer relationship, this investment of time and resources also increases the stakes for the investor, potentially weakening their bargaining position if they become too involved with the startup's potential. Plus, his BATNA becomes weaker if they walk away as there will be sunk costs of the previously mentioned time invested in the company.

This is good news for the founder, who has the strongest increase in their position due to the decrease in the investor's bargaining power. Becoming “closer to eye level, “ as represented graphically by Knott's model.

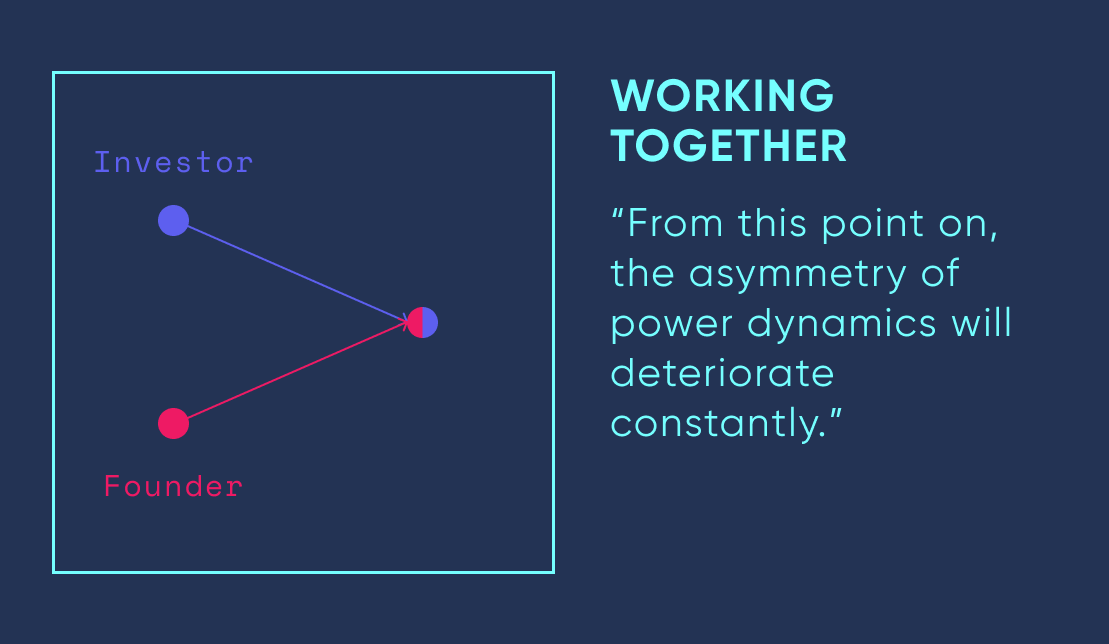

The Investment: A Turning Point

The act of wiring funds marks a pivotal shift in the relationship. Investors transition from potential backers to committed partners, trading their most potent leverage for a stake in the company's future. This transition changes roles, with investors stepping back from operational involvement and relying more on the founders' expertise and transparency to drive growth. For the founder, this is a time to put all their hard work in, and it might seem more attractive to do this than to “waste” time reporting to investors. However, as we'll see later, having clear and transparent communication is key for the relationship's (and to some extent, the company's) success.

Investors now should play the role of mentoring the founder, guiding them through the good, the bad, and the ugly. They come to represent experienced guides with vast experience and can even be a sounding board for those greener founders.

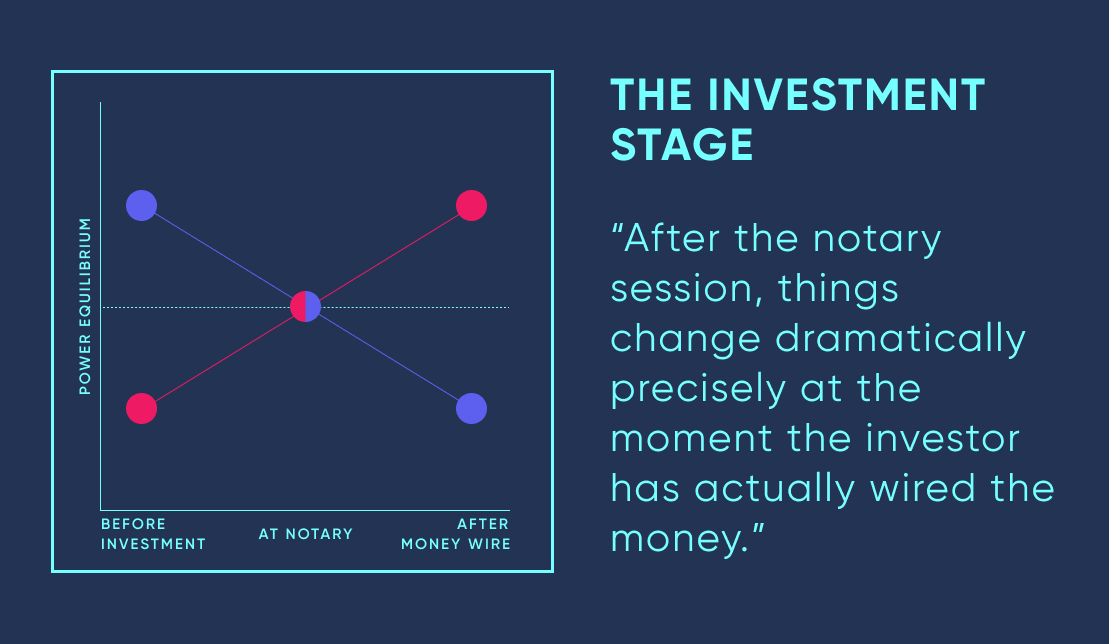

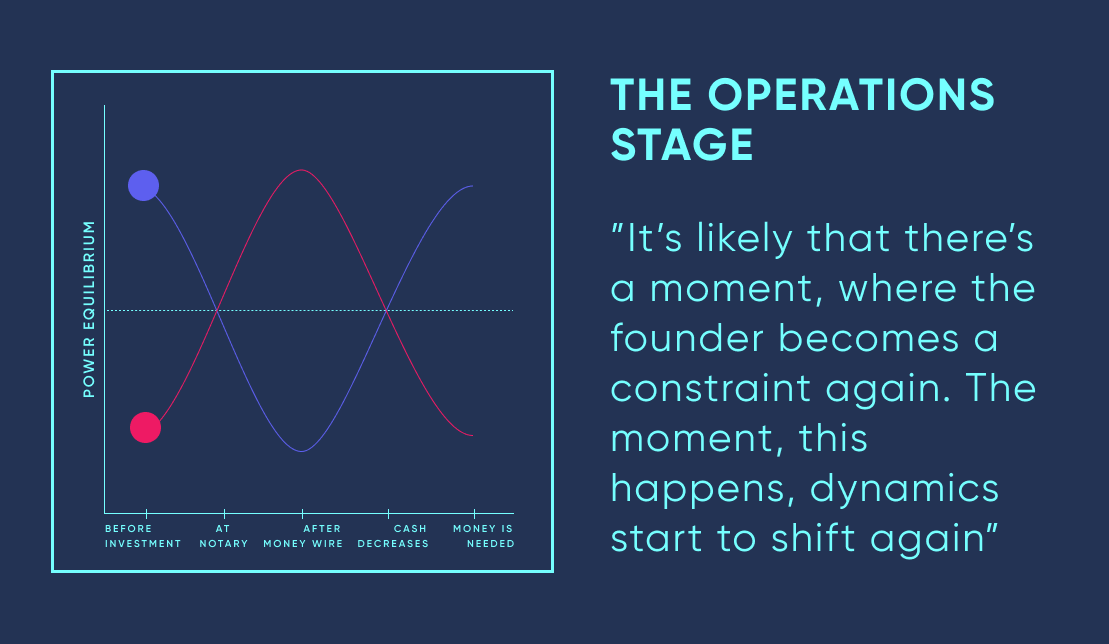

Navigating Operational Realities: The Awakening

Post-investment, the dynamics evolve as operational challenges emerge. And more often than not, founders may need additional funds, facing less mystery and more scrutiny in their relationship with investors. This phase tests the strength of the relationship, highlighting the importance of maintaining open lines of communication and managing power imbalances thoughtfully to avoid detrimental negotiation cycles in future rounds.

This will probably happen many times during the lifespan of the investor-founder relationship, which is why it is so key to guard it. Furthermore, during the initial round, it is key to keep this scenario in mind, as the more the investor uses his power in negotiating an initial deal, the less information the founder will provide thereafter, and the worse the conditions in the next financing round, and so on and so forth.

Strategies for Mitigating Imbalances

Mitigating the imbalances in this relationship requires a conscious effort from both parties. Founders must be honest about their challenges and opportunities, leveraging investors not just for their financial capital but also for their experience, networks, and strategic insights (the so-called “Smart Money”). Likewise, investors should engage with founders beyond mere financial transactions, offering support and guidance and leveraging their expertise to contribute to the startup's success (which, ultimately, is what both of them, investor and founders, want).

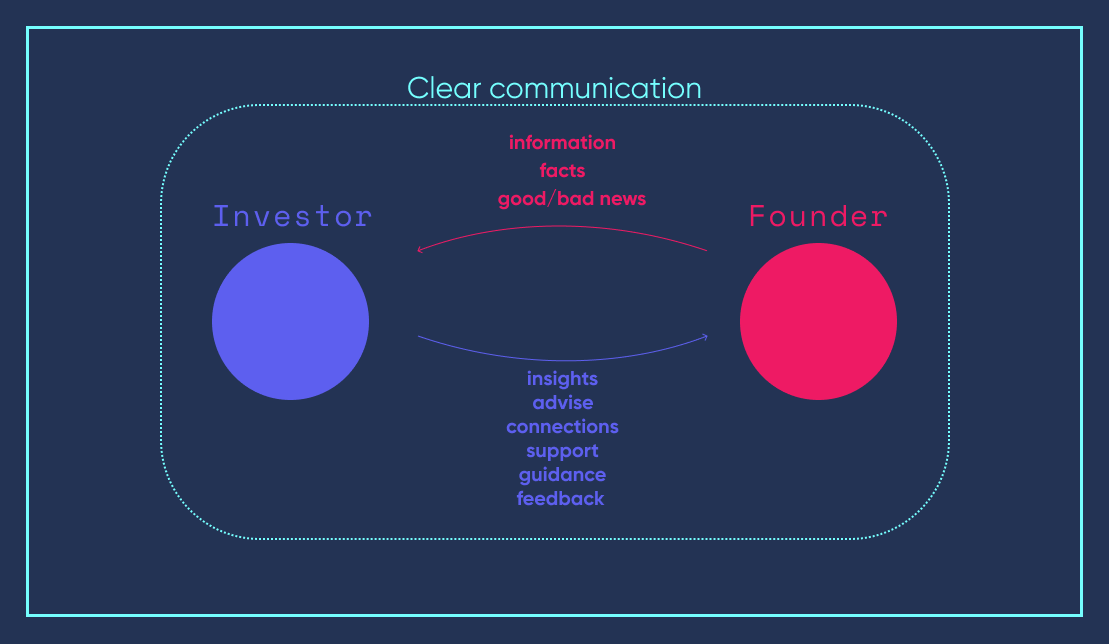

The Role of Transparency and Communication

Transparency and effective communication are essential in maintaining a healthy founder-investor relationship. Founders should not shy away from sharing both good and bad news, as investors can often provide valuable insights, support, and connections to help navigate challenges. Moreover, investors should respect the founder's operational autonomy, offering guidance without being overbearing.

However, sometimes, a lack of aligned expectations can harm the relationship. Oftentimes, founders perceive investors' interests as controlling and coming, not from a place of genuine interest and concern, but from a “where's my money “ approach. However, asking questions and giving feedback might not come from such a place but from a place of real concern and as a demonstration that investors, just like the founders, have their skin in the game and want to show it. This is why clarifying where the concern is coming from at the beginning of the relationship is important.

The fear of losing control of their company looms large for many founders, a concern that can lead to minimized communication with investors. This hesitancy hinders the flow of valuable insights and advice and damages the foundational benefits of a partnership with investors. To mitigate this fear, it's crucial for investors to establish a communication framework that avoids regular scolding, critique, and judgment, which can alienate them from their investors.

Investors can play a pivotal role in calming these fears by demonstrating the tangible value they bring to the table. This involves identifying a balance between guiding and advising without becoming overbearing. By fostering an environment where feedback is constructive, and communication channels are open and respectful, investors can help founders see them as allies rather than threats to their autonomy, encouraging a more open, collaborative relationship that leverages the full spectrum of benefits a strong founder-investor partnership offers.

Founders and investors alike argue that the best formula is to keep investors informed and allow them access so founders get the freedom to act and solid advice on their part.

Building a Lasting Partnership

The ultimate goal of this dynamic relationship is to build a lasting partnership that withstands the ups and downs of the startup journey. This requires mutual respect, understanding, and a shared commitment to the startup's vision and growth. Both founders and investors must be willing to invest time and effort into this relationship, recognizing that their success is deeply intertwined.

In building a lasting partnership, founders should view investors not merely as financial backers but as integral members of their extended team. Proactivity in engaging investors, sharing insights into the startup's progress, and involving them beyond financial reporting can foster a sense of shared mission and mutual investment in the startup's success. Founders should leverage this relationship to gain from the investors' experience, networks, and insights, understanding that an investor's push for performance and introduction to new opportunities is beneficial and necessary. Recognizing that the journey is a collaborative effort helps maintain a healthy relationship, which is vital for times when additional funding becomes crucial.

Conversely, investors should aim to add value beyond their financial contributions and contractual obligations. This includes offering strategic guidance, understanding and supporting through challenges, assisting with budgeting, and leveraging their networks to bring new leads and opportunities. Building a relationship where open communication prevails allows immediate addressing of issues while respecting the founder's autonomy to lead the business. Investors should also practice empathy, especially those from backgrounds different from entrepreneurship, to bridge trust gaps. Demonstrating an understanding of the founder's perspective and enriching their vision with diverse insights can strengthen the partnership, making it resilient through the ups and downs of the startup journey.

Conclusion: A Path to Mutual Success

To navigate the complex association of founders and investors, both must adopt a mindset of collaboration over control, focusing on building a partnership that goes beyond the mere transactional. Founders are encouraged to embrace investors as integral to their team, engaging them deeply in the startup's journey and leveraging their insights, networks, and strategic guidance. In turn, investors are tasked with adding value beyond capital, acting as mentors and allies who support, challenge, and champion the founders in their quest for growth and innovation.

As we look to the future, it is clear that the path to mutual success in the startup ecosystem is paved with open lines of communication, mutual respect, and a shared vision. It shouldn't be about who holds the power or the upper hand but the strength of the partnership and relationship. By fostering a relationship that balances guidance with autonomy, founders and investors can navigate the challenges and opportunities that lie together, unlocking their partnership's full potential and setting the stage for enduring success.