Like in 2020, TC Disrupt took a digital format this year due to covid and the new delta variant hitting the US. However, the event managed to keep its essence: entrepreneurship, success stories, and alternative ways to adapt to this ever-changing environment (now with the bonus of a pandemic). Although the industries and business models showed were very diverse, most of the focus was put on startup companies, specifically in terms of its early-stage challenges, getting funding, and scaling. As a startup ourselves and working with many startup clients, we thought we'd go ahead and cover some of the main talks around setting up a company and putting it on its feet.

Getting that founding

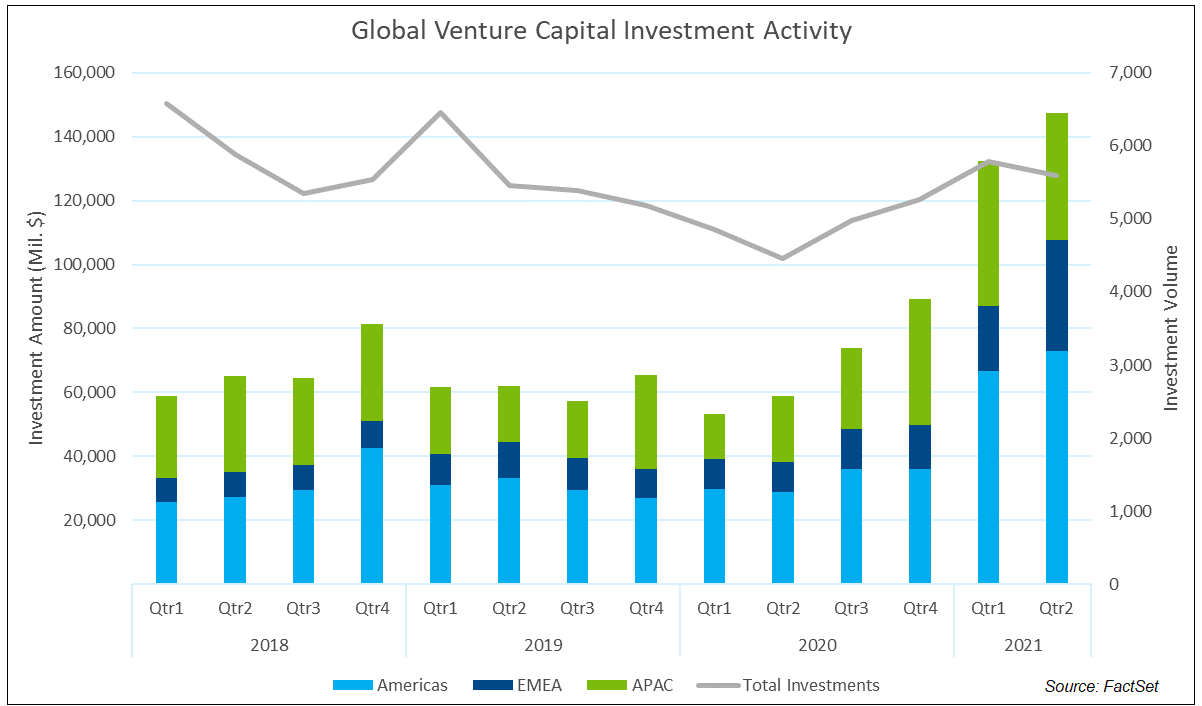

Despite all the negatives this pandemic has brought about, every cloud has a silver lining. Although set out to be hugely affected initially, startups ended up benefiting from COVID, especially when it came to getting funding. The vast amount of tech IPOs and the speed of funding rounds last year reflect this.

Investors were eager to find any way of getting returns, and techs startups seemed on the right track to adapt successfully to this rapidly shifting environment. Furthermore, rounds are getting closed faster thanks, partly, to the rising of remote meetings; you can have more sessions over zoom than if you'd have to move there physically, plus a significant amount of expenses are saved by not having to fly over.

However, although the momentum is excellent, there is fear this bubble, just like in 2001 or 2008, will explode. Harlam's capital Henri Pierre-Jaques said it best: there will be another shift, and investors are waiting for the moment when the music will stop.

The Importance of a North Star

A persistent idea on several of the talks we took part in was that of the North Star. The concept has been going around for a few years in the startup and business environment, but just in case, let's do a recap. Just like the original North Star—Polaris— stays still and constant in the north sky while the rest of starts change, a business North Star is its mission, its purpose. Your North Star should be unchangeable even when all the environment around it shifts. Being clear about a business' North Star helps employees, founders, and investors envision the future and work towards it more efficiently.

Where funding is concerned, a North Star can aid when deciding where to cut and where to spend, whether getting those extra investors' dollars are actually in service of your north star or not. Your purpose should come before fundraising, take a close look, and decide if you're endangering it with how you choose to build money, whether through traditional or non-traditional methods.

Choosing Investors

If the speakers emphasized one thing through the panels, it's the importance of the relationship between founder and investor(s). When accepting funding, it's critical to have specific criteria for investors, especially if it's the first round. The primary advice was to find a firm that's a good match from a cultural, geographical, or industry perspective. Founders are encouraged to pay attention to personal relationships and chemistry between founders and investors. Most people often undermine this aspect, not realizing that you're in for the long run with them.

Entrepreneurs can turn to guidance and mentorships from founders who went through similar journeys. Talk to them about their experiences and relationships with those investors, and ask specifically about how they acted in times of crisis.

Another good strategy mentioned in Preparing for Your Series A is having a clear picture of your ideal investor. List those non-negotiable qualities they need to fulfill and make sure those you consider doing business with fit into that mold. Once you have made up your mind, you're ready to start pitching.

The Importance of a Killer Pitch Deck

Getting in front of potential founders without a good pitch deck is like getting out of your house naked. And for all the good things COVID has done for the startup environment, more funding means more pitching, meaning competition to catch a VC or other investors' attention has increased exponentially; it's harder to stick out. When discussing making a pitch deck stand out, Mar Hershenson, Saba Karim, and Mercedes Bent all agreed on one thing: keep it simple and go back to basics. Here are some of the advice they provided.

Content over design

Nowadays, there's an array of offers regarding presentation designs, from pre-designed templates to video presentations made easier through apps like loom or mmhmm. Although people have started paying more attention to the aesthetic and design aspects, the consensus was: don't get lost on this and focus on the content.

Keep it classy

According to the experts, sometimes being original is to your detriment when it comes to formatting options. A clear and simple 10 to 15 deck should do. The key is that the message comes across efficiently and is not too extensive; being succinct is harder than it seems. When asked about the best pitch they had gotten, Karmi mentioned a podcast sent to him with his name and picture that had caught his eye. However, he reaffirmed the idea that the VC or investor should consume the format efficiently or it will be useless. Video pitches are nice-to-haves (for example, if you have a product to show) but only attached to the presentation and after investors had a look at the deck.

Avoid this no-no's

Other formating prompts were to avoid deck animations at all costs and use PDF over DocSend (you can password protect a PDF as well or block it, but it's a more accessible and popular format). Saba Karim offered pitch deck templates from his website as a good, VC-approved option.

Be careful with page formats

Attendees brought up Notion.so as a new format, which it's only natural after its use blew up in the last couple of years (going from 1 to 4 million users in less than a year). Despite the panel agreeing on the tool's many advantages, they again warned on the dangers of forgoing traditional presentation in favor of other formats. The most common mistake they've seen is entrepreneurs forgetting there's a limit to the amount you can write, and page formats like notion make it easier to ignore this and feed more than people can chew. A long Notion is ok if, and only if, you already had the first meeting or are further down the funnel, but not as a pitch deck or intro card.

Focus on the roadmap

Once you decide on the format, the whole presentation should be oriented towards answering one question: "What does the future look like for your company, and how do I fit in said future?" A key slide is the roadmap because it's easy to talk about what you do know and the vision of where you're going, but venture capitalists want to see the space in between: how you'll grow, how you'll get there. Explain that, and you'll probably get a call.

Think like an investor and drive with data

Be careful with the language you use, especially if you're an academic or Ph.D., learn how investors think and talk, don't go for an approach that's too technical for them. Drive with numbers, especially for seed rounds where they love data-driven CEOs basing their business on quantitative and not qualitative data. During round A, you should have a data room ready as people will want to know more about your business and will ask for data with short notice. A good tip to improve founding rounds is to ask the venture people for feedback on your data.

Get them at "hello"

Jerry Maguire (1999) Source

Canvas Venture's Rebecca Lynn highlighted the importance of "getting the investors at hello." This means hooking them at the beginning. How? Be a phenomenal storyteller, and showcase your excitement. If you can't get excited about your business, no one else will. And remember you control the clock, so make sure you manage the time correctly; articulate what your company does in 30 seconds or less, don't get lost in product demos, make it a dialogue, not a monologue. Ideally, the person should go out of the room and gush about knowing you, so think of a soundbite with which you want them to walk out of the room.

Have unique insight

One of the key messages you should transmit is the way you think about the market. Investors look for founders with unique insights into the industry that others haven't thought of or realized yet. Founders will ask themselves, "Why this entrepreneur and why this entrepreneur for this problem?" Think about your motivation; it's not the same starting a business out o boredom as doing it because you have experienced the pain point you're tackling. Consider your expertise. Do you possess the ability to have domain expertise or build it quickly? Investors will support founders they can dream with and think on the same paths in terms of ambition. They want to make sure founders live and breathe their company or market.

This is especially true for seed rounds when investors will most likely stand behind someone with a distinct vision backed up and transmitted through their deck.

Try the fast lane

For entrepreneurs looking for funding, pitch decks are usually a necessary evil. However, the panel of experts encouraged founders to connect on a personal level with potential investors. If there's any chance to avoid pitches and have a direct conversation where you can get your ideas across (you still need to be clear and concise even if you're not presenting anything), you should go for it. To achieve this, you don't need to have a long trajectory or be well known in the business; you need only to take advantage of the support structure of the entrepreneurial tech scene. Most entrepreneurs support each other, so look on the VC or investors portfolio and reach out through connections in common or LinkedIn to entrepreneurs they have previously founded to ask for an introduction. Sequoia Capital's Luciana Lixandru pointed out that, although they appreciate founders reaching them directly, the European ecosystem is a bit more fragmented than Silicon Valley, so emails are more welcomed if you don't have shared connections. She recommends keeping them short and to the point and explaining why you are not just better but different.

Remember...

More often than not, founders forget the goal of the pitch deck is just to get the meeting, an entry point to what happens afterward, and try to put all the information there. Don't do this; simplicity is always best. The faster and simpler you can get your narrative across, the better. You won't get bonus points for a good design, but it doesn't hurt to have one either; just focus on what's important. They will still be looking at the business, so spend the appropriate amount of time and resources on design and get on with transmitting your ideas clearly. A piece of advice that was constant through the panels, however, was don't get discouraged. Be prepared and be yourself. If you have a good and solid business, it will shine through.

How to get Alternative Founding

Clearco founder Michele Romanow and Accel partner Arun Mathew talked with TC editors and gave some tips around non-traditional fundraising. Most entrepreneurs immediately think of bank loans or Venture Capital when seeking funding. Bank loans are not always an option for early-stage entrepreneurs, and venture investment doesn't always make sense for tech companies; it's expensive, and there are certain expectations you need to fulfill. Even for SaaS companies, there needs to be a big enough market you're investing in.

Below we summed what the panel discussed and some of the possibilities for entrepreneurs looking to get investment.

How to chose a founding method

Before making up your mind about the type of funding you're going for, you need to think clearly about what your endgame is. If you're going for debt, is it worth the risk for your company? Do you have the assets for it? Are you willing to give up your company's ownership if you can't pay? Research which type of capital is best for your company's strategy before making any decisions.

You can also consider mixing up different sources of capital. Mathew mentioned venture capital and non-dilutive capital are not mutually exclusive (in the first one, you usually give up equity, whereas, in the latter, you don't). Maybe if you haven't found your product-market fit, getting VC and forming a board that helps you move forward with their expertise might be a good idea.

Revenue-based financing

Romanow's company Clearco is an excellent example of RBF. They lend up to 10 million to startups and don't have a due date on full repayment; instead, they'll get a percentage of the business's future revenues until they pay the loan in full plus a flat 6% fee on capital. The panel discussed some misconceptions around RBF, such as it's a lengthy process (companies like Clearco do deals online and, through AI algorithms, can rank companies in a matter of minutes). Another myth is that RBF only looks at revenue, while in reality, they look for experience or unique insight; they care about the traction you have. It's also common to hear that it's an expensive alternative, but, as seen with the Clearco fee, that's not always the case.

COVID's impact - the hurdles of raising capital in a remote environment

As mentioned previously, remote reality significantly impacted founding, especially the pace at which rounds are closed. The exit environment has also increased, and it's now much faster. An increase in speed is not always good news when building relationships with investors, as it becomes harder to create one-on-one bonds between them and the founders. Faster times are not necessarily good, these relationships are like long-term marriages, and it's more important to find a partner that's right for you than to find one quickly.

Final notes

The good news is, there are plenty of opportunities for founders to get capital, and if one doesn't work, you can keep going through other alternatives. Founding a company has never been easier. People are very willing to buy good products from companies with vision, so, once again, don't give up and focus on traction before fundraising while remembering your north star.

Post-Founding Growth

What to do once you already got those investment dollars? Growing a business is no easy task, and there are several things to get out of the way now you already have the money you so desperately need. But where to start? What to invest in? Below we made a quick recap of three panels that dealt with this subject and the main outtakes that'll help answer these questions.

Make the critical hires first

InIn the Where to Cut and Where to Spend in First-Check Fundraising panel, Henri Pierre-Jacques, Richard Kerby, and Nisha Dua highlighted the importance of making those critical hires first and foremost. They mention not making them when spending that first check as one of the biggest mistakes founders could make, so hiring is a priority. The role of that key member will be defined by your business model and your north star, but it should be someone that will have their skin in the game and stick by your side in the long haul. For tech companies, hiring engineering talent also presents a challenge. However, it's essential to differentiate between those 2 or 3 significant hires and your technical team. Working long-term with someone means you shouldn't hurry to make a choice; there's an expectation founders should be racing towards those big hires, but, just as with your investors, slow and steady wins the race.

Decide: Build or Buy

In the tech industry, there's always the question of whether or not to outsource engineering talent. To know if it's the best solution, you should consider two things:

- How valuable is your time: sometimes, it's better not to save those extra dollars and hire an agency hiring, so you don't have to do it all yourself, especially in this remote environment, where you don't even need to be in the same geographical location.

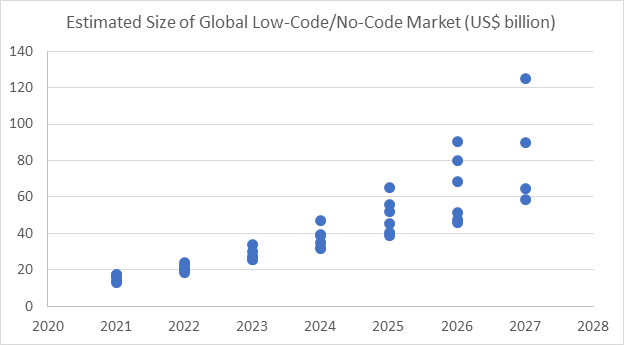

- What's the big differentiation of your company: despite the costs, experts don't recommend outsourcing those critical technical aspects that differentiate your company from competitors. So think if what you're outsourcing will compromise your differentiator. Today, you can also consider the array of no-code solutions if a technical aspect is not critical but may be time-consuming or expensive to have in-house.

Prepare for a rainy day

It's crucial to squirrel away some money for a rainy day (a.k.a emergencies, like a global pandemic or a recession). As mentioned, Pierre-Jacques believes investors are waiting for the market to slow down again, so they will be worried about solvency and emergency funds. The best option is to plan for a longer runway (i.e., the number of months a company can keep operating before it's out of cash). Most startups operate on an 18 to 24-month runway despite the fair amount of capital in the market.

Build your brand before advertising

On How to Accelerate Everything, panelists prompted companies to build a brand foundation before turning on their growth efforts. This is key if you want to be a brand instead of simply a product company. Nik Sharma, CEO of Sharma Brands, said the best way was to think about marketing vs. advertising in the following terms: marketing is a digital image of your company, and advertising is when you enlarge the image, and you stretch it, and the more you stretch it, the more important is that the image is good quality; otherwise it will look blurry.

Building brand equity in the early days is SO crucial for success.

— Nik Sharma (@mrsharma) July 9, 2021

You can’t just rely on ads. pic.twitter.com/S6qi08Drvc

A brand will most likely attract a community around it. You should build that from the beginning; if you have achieved product-market fit, your first customers should come organically because you're addressing a need.

Boost your channel strategy

Now you have that brand up and running; it's time to choose the channels you're going to advertise. It would be best if you started with small and straightforward attribution models. Attribution models are a technique that evaluates all the customer journey touchpoints to know how much influence each channel had on a sale by assigning frictional credit to each one. Focus on as few channels as possible, especially at the beginning. The more effort, time, and resources you can spend figuring out which channel is the best one instead of trying to tackle all at once, the better.

A good strategy to see if the channels are working is to run plenty of holdout tests for each one and the strategy you have in place. Holdout testing means turning a channel off to see what happens to the acquisition cost or changing the strategy (for example, the demographics you're targeting) to see what changes. This exercise helps measure and evaluate target-specific and channel-specific performance.

Once you have the channels, how do you know you've found a growth loop? Easy, ensure the channel is scalable and that it's the right fit for your particular product.

Select the right metrics and benchmarks

To choose the metrics and benchmarks that are right for you, it's essential to understand the metrics that matter at a company level; all the other metrics (those critical to marketing, sales, etc.) are in service of achieving company goals. Try to know your metrics right from the beginning and which ones you need to hit at your next funding round. Benchmark with other companies or ask your investors to make sure you're looking at the correct numbers.

Prepare for Series A

Most companies are unsure about when it's time to go out and look for further funding, that is, starting their Series A round. Founder Kadie Okwudili said fundraising is good when it's naturally the next step. It's not so much "I want to raise money" but more "I need to raise money." Ask yourself, when will the money get you to a level you'll not be able to achieve otherwise.

Fundraising should be a catalyst to something happening that's already there, the business growing so fast you can't meet expectations without that money.

"Look at what you have to solve, understand the problem, and ask yourself if capital can accelerate what you have already validated and understood." *Tope Awotona, CEO of Calendly (Calendly, From Bootstrap to Billions)

However, be careful with the timing. As mentioned, most companies run on a year and a half to a two-year runway, but speakers stressed the importance of not waiting for the money to run out to go out and start raising. Negotiating with no liquidity will leave you with no leverage whatsoever, and you should avoid that at all costs.

To be prepared for Series A, you should know the difference between these and seed rounds. In the latter, investors are interested in community-based engagement, and you are trying to validate the product with customers. Now the product is validated, they'll be looking at retention; customers should not only use but love your product, so focus on product-market fit. People will invest in a product they can see customers will use for years to come and will incorporate it as part of their lives. To get there, collecting data from the community of users before series A might be a good idea.

How do you know you've reached product-market fit?

Product-market fit (PMF) is a widely used concept, but different people have different metrics for it. David Thacker of Greylock, Heather Hartnett (Human Ventures), and Felicis Ventures's Victoria Treyger shared some insights in their panel about The Subtle Challenges of Assessing Product-Market Fit.

PMF depends on the stage of the startup and, often, on external factors of the industry that hint at specific needs, growth opportunities, and potential customers. The definition, or the metric, most associated with PMF is the customer acquisition cost.

Other metrics, such as NPS ("Net Promoter Score"), are used to simplify the decision-making process, but a little information is sometimes lost in the way. It's critical to look at the data and the metrics individually. It's also important to learn how a company acquires new users. Is it organically, through word of mouth, trends, etc., or does it pay to acquire them? What's the ratio of organic vs. paid users? Do users/customers promote the service? Do they "evangelize"?

The more early-stage the company is, the more difficult it is to see the PMF clearly, so it's not a good idea to have it as a reference. We can, however, consider other variables, such as:

- Is the company creating value?

- Does the product/service do what it's supposed to? Can we measure that?

- Do users abandon the service after the free trial ends?

It's essential in those early days to have a clear understanding of what's going on in the industry and the market, and you need to trust the entrepreneur's resumè. It has been noted that those companies whose founders identify with the pain point they're trying to solve have higher chances of growing and developing. Ask yourself, is the pain point I'm tackling good for me, or for the market?

"We provide a product/service that solves a real problem and provides true value. This is Calendly. Time-saving, improved retention and the chance of outcome of that meeting are just some value propositions. Tope Awotona, Calendly 's CEO — Calendly, From Bootstrap to Billions

And what happens with those founders looking for capital while they're defining the PMF? Before looking for funding, you need to have information from the users and the market that supports the business's development. It should be first-hand information; it's not a good move to outsource the initial market and user research. The founder should be in the research process and understand his product's use cases. There has to be an understanding by the founder so they can constantly look for accurate indicators of PMF. An excellent way to achieve this is to look for product validation constantly.

Other hints of a healthy PMF are:

- Disruptive companies are using your product pre-Series A — "Are the cool kids using it?"

- Good expansion and retention metrics.

- Efficiency acquiring new users.

- A 60/40 percentage of organic and paid users, respectively. This reflects an excellent inbound pool. Referral codes are a good way to measure advocacy at the beginning.

- If the payback cycle of client acquisition is less than a year, it's great; if it's less than six months, it's excellent.

- For hardware/physical products, the PMF is measured in the long term. People need to understand how the product is used and for how long. It's a 2 to 3-year cycle in which there needs to be an understanding of whether users are acquiring new versions of the product.

As for the value a company delivers, in developing products, the focus needs to be doubling efforts on what makes it unique, its differential from competitors. A product that's a "swiss army knife" (tries to do everything) makes it harder to transmit a specific message. At the outset, the main thing is to have identified a pain point correctly and articulate the benefits of your product based on it.

What happens with underrepresented entrepreneurs?

Hana Mohan, Stephen Bailey, and Leslie Feinzaig talked about a topic sometimes overlooked within the startup industry, although gaining visibility in the last few years. Being an entrepreneur is never easy, but what about those with other disadvantages like their race or gender? How does this affect them in their path to business growth?

Feinzaig shared her experience trying to raise capital in Silicon Valley and how the view that the place is a meritocracy is a myth entirely. Although it's an idea we all wanna believe in, it takes a certain amount of courage (or what she described as a "gaslit experience") to question that. In the early stages of a startup, you are not raising out on your idea, what matters is how you execute, and Leslie found that depends partly on your resources, and not everyone has the same amount. She mentioned connections were also crucial to get meetings in Sand Hill Road. Investors weren't always interested in founding women and risked them getting pregnant and quitting their business.

Popular career advice doesn't work for women. I want to re-write all the books.

— Leslie Feinzaig 🎃 (@LeslieFeinzaig) September 21, 2021

"Rich mom, poor mom."

"How to win friends & influence people without playing dumb or being labeled a bitch"

"The 7 habits of highly effective people who don't have a housewife & full time help"

Bailey said that being an entrepreneur in a minority group sometimes means being asked for more proof from investors or business partners. It also implicates not always finding mentorship because people want to help those who look like them.

Language is another barrier and not the kind you might think. According to the panel, investors have their own language, and you need to speak it. The problem for minorities like women is that the jargon tends to be high in bravado, expressions like "crashing the competence" are not uncommon; however, women using this kind of language are usually perceived as "too aggressive" or "unlikeable" because of the prejudices against ambitious and loud women.

With all these obstacles being thrown at you, it's easier for your confidence to be undermined. But the panel insisted on the importance to build it up and shared some of their tactics:

- Don't allow others to define you ("you are so and so, you must know about XYZ"), or it will mess up your sense of purpose, your ambition, and what makes you unique as a leader.

- Do things that take you to a place of confidence, such as

- Know what you can do and remind yourself of those things

- Remind yourself why you're doing it; if you lose your purpose, you lose your confidence.

- Know that you're going to be successful; that's out of the question. What you need to ask is, "Are you joining me or not? I'd love to do it with you, but I am also capable of doing it without you."

- Know that those who succeeded are not necessarily better or more clever, nor worse than you. Don't make room for resentment.

- Don't overwork or feel the need to do something all the time, that may come from a place of doubt. Center yourself and prioritize what matters.

Speakers also mentioned tokenism, the fake idea that things are changing and steps are being taken. However, they believed that this is not about minorities adapting but about systems and dynamics changing. For women, this means being comfortable to talk to each other about money and investing and starting a vicious circle by women founding women. But the best thing to bring about change is to be transparent and report; the more you hold the organizations accountable for what they do, the more they'll change.

Rounding up

A lot was said about the startup landscape in the several panels we participated in. And although the challenges are many and vary according to who or where you are, we believe startups and founders should take away the following ideas. It has never been easier to start a business or get funding from various methods, and remote environments democratized access to funding. People are willing to invest and buy on business with vision.

We hope you got major tips and takeaways from the 2021 TC Disrupt and please reach out if you wanna learn more about growing your business. Thanks for reading! 😊